Solutions

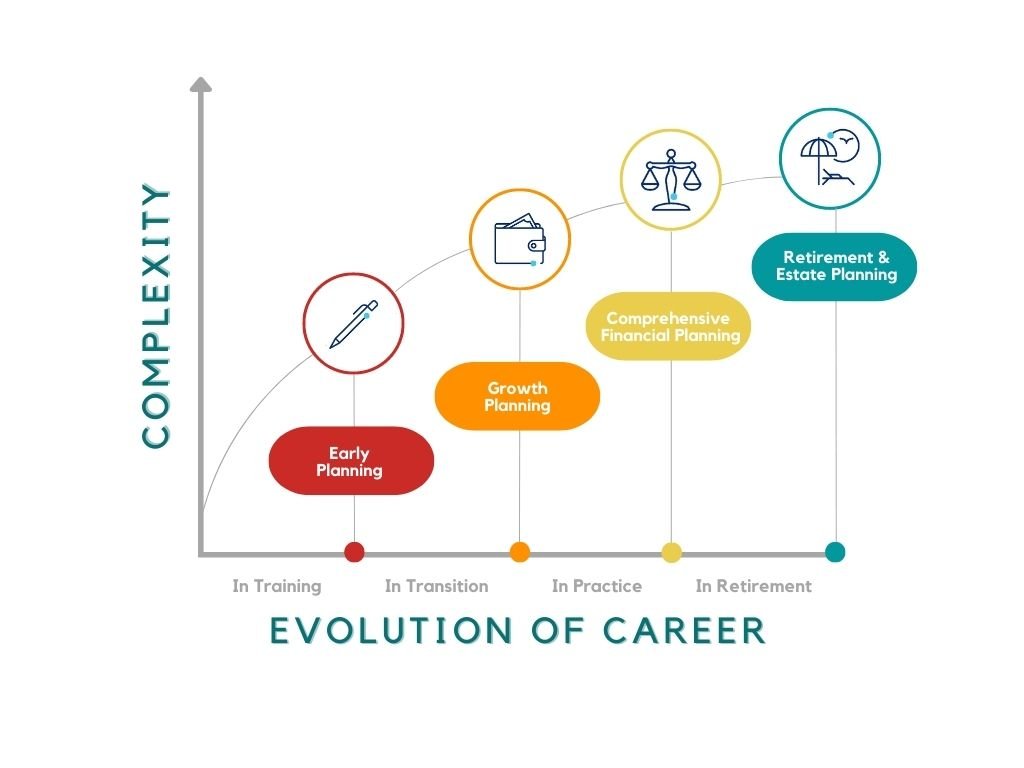

From Student To Practitioner

Our planning process is guided by establishing trust and demonstrating integrity during every client interaction. Expect access, attention to detail, and strict confidentiality in every client engagement with our team.

It all begins with an idea. Maybe you want to launch a business. Maybe you want to turn a hobby into something more. Or maybe you have a creative project to share with the world. Whatever it is, the way you tell your story online can make all the difference.

Long-term Disability Insurance for Dentists

Protection for your most valuable asset: your ability to earn an income

True Own-Occupation contract language

Coverage to include monthly student loan payments if disabled.

OHSU School of Dentistry discounts available

Offering coverage from most major insurers

Student-Loan and Debt Management for Dental Practitioners

Helping you plan a path forward towards repayment.

Review of payment options, deferment options and forgiveness options.

Review of refinancing options

Goal Setting and Financial Planning for Dental Practitioners

Short-term and Long-term financial plans unique to new dentists

Budget planning and prioritization

Thoughtful risk-based planning

Being a valuable team member to include your attorney, CPA and lender.

Our planning process is guided by the financial goals of individuals and families alike. It’s designed to help navigate the many challenges of transitioning from school or residency, to becoming a practitioner.

Apply for Life Insurance

Powered by Coverpath

The Coverpath platform provides an online life insurance purchasing and policy delivery experience for clients with:

An easy online application so you can skip the face-to-face meeting and apply when it’s convenient for you.

Availability of an experienced financial professional if you need assistance or have questions about your coverage needs.

Innovative technology backed by MassMutual, a veteran in the life insurance industry.